안녕하세요 네이버 블로거&유튜버 황진범입니다.

세무회계·회계관리 1급입니다.

2020년1월1회에 시행된 회차로 세무회계는 2020년도에 출제된 것이며 2021년은 개정이후 문제를 적용해주시면 감사하겠습니다.

해설은 2022년도 기준으로 한 것입니다.

세무회계는 70점 이상일 경우 합격합니다.

재무회계, 세무회계가 각 70점 이상인 경우, 합격하는 것으로 평균 70점은 아닙니다.

해설을 시작하겠습니다.

회계관리1급 2022년1회 기출문제 다운로드 첨부 파일 2022년1월.pdf파일 다운로드 안녕하세요 네이버 블로거&유튜버 황진범입니다.

세무회계·회계관리 1급입니다.

2020년1월1회에 시행된 회차로 세무회계는 2020년도에 출제된 것이며 2021년은 개정이후 문제를 적용해주시면 감사하겠습니다.

해설은 2022년도 기준으로 한 것입니다.

세무회계는 70점 이상일 경우 합격합니다.

재무회계, 세무회계가 각 70점 이상인 경우, 합격하는 것으로 평균 70점은 아닙니다.

해설을 시작하겠습니다.

회계관리1급 2022년1회 기출문제 다운로드 첨부 파일 2022년1월.pdf파일 다운로드

회계관리 1급 2022년 1회 재무회계를 보실 분은 링크를 클릭해주시면 감사하겠습니다.

회계관리 1급 2022년 1회 재무회계를 보실 분은 링크를 클릭해주시면 감사하겠습니다.

[회계관리 1급 기출문제] 회계관리 1급, 2022년 1월 – 문제해결 및 해설(재무회계, 2022년 1회) 안녕하세요. 네이버 블로거&유튜버 황진범입니다.

2022년 제1회 회계관리 1급을 재무회계입니다.

재무회계…blog.naver.com [회계관리 1급 기출문제] 회계관리 1급, 2022년 1월 – 문제해결 및 해설(재무회계, 2022년 1회) 안녕하세요. 네이버 블로거&유튜버 황진범입니다.

2022년 제1회 회계관리 1급을 재무회계입니다.

재무회계…blog.naver.com

삼일회계법인 자격시험 회계관리1급 2022년1월 세무회계 기출 삼일회계법인 자격시험 회계관리1급 2022년1월 세무회계 기출

正解1番、ㄱ、ㄴ、ㄷ 正解1番、ㄱ、ㄴ、ㄷ

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 2. People are also obliged to pay taxes that are not based on the tax law Answer number 2. “People are also obliged to pay taxes that are not based on the tax law.”

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 1, “Corporate tax on profitable business income out of all source income at home and abroad” Answer number 1, “Corporate tax on profitable business income out of all source income at home and abroad”

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 3 (A) 37,000,000 won (B) 3,000,000 won Answer number 3 (A) 37,000,000 won (B) 3,000,000 won

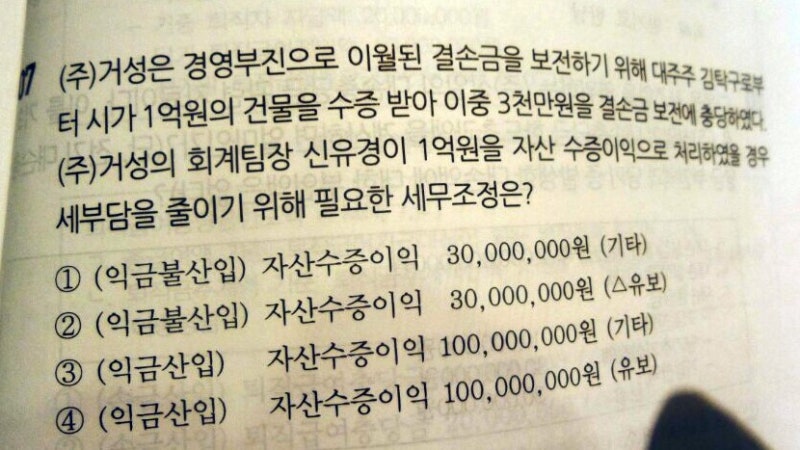

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 4. “The day you decided to receive the price of assets other than products” Answer number 4. “The day on which we decided to receive the consideration for assets other than commodities”

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 4. “Jamsil Co., Ltd. paid only 2,000 won for shares with a face value of 5,000 won while carrying out potatoes.” Answer number 4. “Jamsil Co., Ltd. paid only 2,000 won for shares with a face value of 5,000 won while carrying out potatoes.”

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer #3 (No deductible expenses) In) Retirement allowance limit exceeded 3,000,000 (bonus) Answer #3 (No deductible expenses) In) Retirement allowance limit exceeded 3,000,000 (bonus)

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 2. Under the Corporate Tax Act, assets are not allowed to be evaluated under the low-priced method. Answer number 2. Under the Corporate Tax Act, assets are not allowed to be evaluated under the low-priced method.

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 3, 19,191,900 won Answer number 3, 19,191,900 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

If the entertainment expenses of the correct answer No. 3 are provided as assets other than money, the value of the assets shall be based on the book amount when providing them. If the entertainment expenses of the correct answer No. 3 are provided as assets other than money, the value of the assets shall be based on the book amount when providing them.

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer #2. Claims of KRW 1 million or less, more than a year after the collection date Answer #2. Claims of KRW 1 million or less, more than a year after the collection date

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 1. When a corporation lends money to a person concerned at a low interest rate other than free lending, it carries out the recognized interest on provisional payments Answer number 1. When a corporation lends money to a person related to a special relationship at a low interest rate other than free lending, it carries out the recognized interest on provisional payments

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 3, the deficit under the Corporation Tax Act is always consistent with the net loss amount for the current period in the income statement. Answer number 3, the deficit under the Corporation Tax Act is always consistent with the net loss amount for the current period in the income statement.

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Correct answer number 1. Losses carried forward when calculating the corporate tax base are deducted regardless of the business year in which they occurred. Correct answer number 1. Losses carried forward when calculating the corporate tax base are deducted regardless of the business year in which they occurred.

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer: 2,500,000 won. Answer: 2,500,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 2. Answer number 2 on March 31, 2023. March 31, 2023

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer #3. Income tax law adopts an enumeration-based tax system, so income that is not listed, such as interest income and dividend income, is taxed Answer number 3. Since the Income Tax Act adopts an enumeration-based tax system, income that is not listed, such as interest income and dividend income, is taxed

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 1. “Residents are obliged to pay taxes not only on income earned in Korea but also on income earned in foreign countries.” Answer number 1. “Residents are obliged to pay taxes not only on income earned in Japan but also on income earned in foreign countries.”

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer No. 4. Kim Young-soo, interest income 1,500,000 won, answer number 4 Kim Young-soo’s interest income 1,500,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer 2, 1,100,000 won, Answer 2, 1,100,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer: 3,600,000 won. Answer: 3,600,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer No. 4 Other Income Answer number 4 Other Income

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 2, 120,000 won, Answer number 2, 120,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 4. Income generated by business selling real estate is also taxed as capital gains if it is subject to capital gains tax Answer number 4. Income generated by business selling real estate is also taxed as capital gains if it is subject to capital gains tax

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer No. 2. Those who only have fair pension income can end their tax obligations only by filing a comprehensive income tax return. Answer No. 2. Those who only have fair pension income can end their tax obligations only by filing a comprehensive income tax return.

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

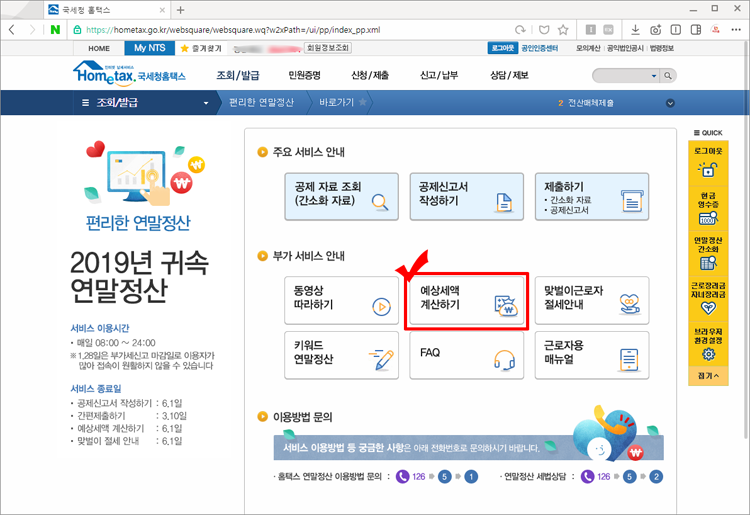

Answer No. 1 In the case of mid-career retirement, the year-end adjustment will be made until the end of next month, the month of retirement. Answer No. 1 In the case of mid-career retirement, the year-end adjustment will be made until the end of next month, the month of retirement.

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer #2. Capital gains Answer #2. Capital gains

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

The answer is number one. The answer is number one

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

The answer is number 3, 700 won, and the answer is number 3, 700 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

The answer is number four. The answer is number four

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 2, 380,000 won, Answer number 2, 380,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

If the small percentage of the correct answer number 1 is applied, not only the relevant transaction stage but also the value-added tax generated at the previous transaction stage will be taxed If the small percentage of the correct answer number 1 is applied, not only the relevant transaction stage but also the value-added tax generated at the previous transaction stage will be taxed

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 2 a,b,e,f Answer number 2 a,b,e,f

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer: 40,000,000 won. Answer: 40,000,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 2. 29,000,000 won. Answer number 2 29,000,000 won

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer No. 4 Final Return for the 2nd Term of 2022 KRW 10,000,000 Answer No. 4 Final return for the second term of 2022 KRW 10,000,000

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer #2. Statement of entertainment expenses Answer #2. Statement of entertainment expenses

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer No. 4. Where the taxpayer reports the value-added tax refund less than the amount to be reported Answer No. 4. Where the taxpayer reports the value-added tax refund less than the amount to be reported

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

Answer number 3, Director Yang, Answer number 3, Director Yang

(iii) Qualification examination for Issu Accounting Corporation Accounting Management Level 1 January 2022 Tax Accounting Past papers: Sanitsu Accounting Corporation Qualification Examination Accounting Management Level 1 January 2022 Tax Accounting Past papers

If the general taxpayer No. 4 is issued a credit card sales slip that can separate the value-added tax, tax deductions are possible. If the general taxpayer No. 4 is issued a credit card sales slip that can separate the value-added tax, tax deductions are possible.

I finished explaining and explaining all the questions. Tax accounting was implemented in 2022, and the law was also applied in 2022. Tax accounting is not difficult in itself, so you can do it if you prepare enough. I hope you will be of great help to me by passing the first level of accounting management for the finance manager. There are other problems with the first level of accounting management. I’d appreciate it if you could watch it a lot. I hope it will be helpful and pass for those who will see it after 2023 and 2024. 2023.10.13 Sponsored by 31 Accounting Corporations Accounting Management Level 1 January 2022 – Problem Solving and Explanatory Author Hwang Jin-beom I finished explaining and explaining all the questions. Tax accounting was implemented in 2022, and the law was also applied in 2022. Tax accounting is not difficult in itself, so you can do it if you prepare enough. I hope you will be of great help to me by passing the first level of accounting management for the finance manager. There are other problems with the first level of accounting management. I’d appreciate it if you could watch it a lot. I hope it will be helpful and pass for those who will see it after 2023 and 2024. 2023.10.13 Sponsored by 31 Accounting Corporations Accounting Management Level 1 January 2022 – Problem Solving and Explanatory Author Hwang Jin-beom

출처 www.samilexam.com 출처 www.samilexam.com

Samil Accounting Corporation Acceptance Period: Exam Date: Acceptance Period: Exam Date: [Examination Guide] Check [Information Square] to get information faster. · September 23, 2011 Finance and Economy Manager/Accounting Management Qualification Examination Final Answer Guide <40th Award Ceremony for Excellence in Performance>·[Announcement] October 4 (Wednesday) Closed – [Announcement of Passes] Announcement of Passengers October 2 (Monday) 1pm – September 23, 2011 Finance and Economy Manager / Provisional Answer Guide for Accounting Management Qualification Examination www.samilexam.com Samil Accounting Corporation Acceptance Period: Exam Date: Acceptance Period: Exam Date: [Examination Guide] Check [Information Square] to get information faster. · September 23, 2011 Finance and Economy Manager/Accounting Management Qualification Examination Final Answer Guide <40th Award Ceremony for Excellence in Performance>·[Announcement] October 4 (Wednesday) Closed · [Announcement of Passes] Announcement of Passengers October 2 (Monday) 1:00 p.m. · September 23, 2011 Financial Manager/Provisional Answer Guide for Accounting Management Qualification Examination www.samilexam.com

I would like to inform you that the qualification exam hosted by Samil Accounting Corporation was prepared to help the examinees, so there is no other intention. I would like to inform you that the qualification exam hosted by Samil Accounting Corporation was prepared to help the examinees, so there is no other intention.

![[상속 전문 세무사] 법인 가수금도 상속재산에 해당합니까? [상속 전문 세무사] 법인 가수금도 상속재산에 해당합니까?](https://t1.daumcdn.net/cfile/tistory/252946425954B14F1F)

![STOCK - 해외주식[Part3] : 마이크로소프트 MSFT STOCK - 해외주식[Part3] : 마이크로소프트 MSFT](https://car.wayinbu.xyz/wp-content/plugins/contextual-related-posts/default.png)